Update your CRA information: Set up or change direct deposit

Set up or change direct deposit with the Canada Revenue Agency.

Who is the direct deposit for?

- an individual with personal taxes, benefits or refunds

- a business

- a trust

- a non-resident

Direct deposit for personal taxes, benefits or refunds

You can get these CRA payments by direct deposit if you have a Canadian bank account:

- income tax refund

- GST/HST credit and any similar provincial and territorial payments

- Canada child benefit and any similar provincial and territorial payments

- working income tax benefit

- deemed overpayment of tax

If you’re changing banks, don’t close your old bank account until we have deposited your first payment to your new bank account.

- Online:

-

Set up or change direct deposit immediately using My Account

Alternative: MyCRA web app

- By phone:

-

Set up or change direct deposit by phone

- Before you call

-

To verify your identity, you'll need

- Social Insurance Number

- Full name and date of birth

- Your complete address

- An recent tax return, notice of assessment or reassessment, other tax document, or be signed in to My Account

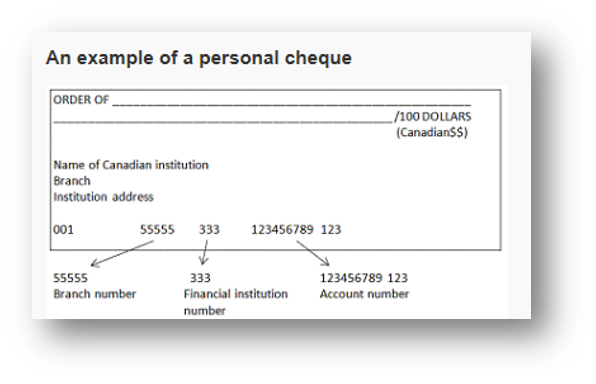

- Banking information: 3-digit financial institution number, 5-digit transit number, and your account number (found on your bank statement or personal cheque)

If you are calling the CRA on behalf of someone else, you must be an authorized representative.

- Telephone number

1-800-959-8281

Yukon, Northwest Territories and Nunavut:

1-866-426-1527Outside Canada and the U.S. (operates in Eastern Time):

613-940-8495- Hours

Hours in local time

Day Hours Mon to Fri 9 am to 5 pm (closed on public holidays) Sat and Sun Closed

- In person:

-

Set up or change direct deposit at your bank branch

Some banks and financial institutions in Canada can help you set up direct deposit for CRA payments. This service is currently offered by:

- By mail:

-

Set up or change direct deposit by mail

- Complete the Canada Direct Deposit enrolment form

- Mail the completed form to the address on the form

It may take up to 21 days after receiving the form to process this change.

Direct deposit for a business

A business can get these CRA payments by direct deposit:

- corporation income tax refund

- GST/HST refund

- refund of excise tax or other levies

- refund of payroll deductions

- Online:

-

Direct deposit is only available online.

Set up or change direct deposit for business using My Business Account

Alternative: Represent a Client

- Get help:

-

Call for more information

Business direct deposit must be set up online. It cannot be done by phone. Call for information only.

- Telephone number

-

1-800-959-5525

Yukon, Northwest Territories and Nunavut:

1-866-841-1876Outside Canada and U.S. (operates in Eastern Time):

613-940-8497 - Hours

-

Hours in local time

Day Hours Mon to Fri 9 am to 6 pm (closed on public holidays) Sat and Sun Closed

Direct deposit for a trust

Sign up for direct deposit for a trust if you are the trustee, custodian, executor, or other type of legal representative for a trust receiving payment. The name on the bank account must match the name of the trust.

- By mail:

-

Direct deposit is only available by mail.

- Complete Form T3-DD, Direct deposit request for T3

- Mail the completed form to the address on the form

Alternative form: You can complete the direct deposit area of the applicable Form T3RET, T3 Trust Income Tax and Information Return

It may take up to 21 days after receiving the form to process this change.

- Get help:

-

Call for more information

- Telephone number

-

1-800-959-8281

Yukon, Northwest Territories and Nunavut:

1-866-426-1527Outside Canada and the U.S. (operates in Eastern Time):

613-940-8495 - Hours

Hours in local time

Day Hours Mon to Fri 9 am to 5 pm (closed on public holidays) Sat and Sun Closed

Direct deposit for trusts must be set up by mail. It cannot be done by phone. Call for information only.

Direct deposit for a non-resident

You may set up or change direct deposit if the following is true:

- you are a Canadian payer or agent

- your non-resident tax account starts with NR, followed by one more letter, and then six digits

- Example: NRX123456

- your Canadian bank account is registered in Canada

- your Canadian bank account and your non-resident tax account are under the same name

If you are filing a NR7 Application for Refund, you can also sign up for direct deposit for the refund. The name on the bank account must be the same as the name of the person who signed Form NR7-R.

- By mail:

-

Direct deposit is only available by mail.

Set up or change direct deposit by mail

- Complete Form NR304, Direct Deposit Request for Non-Resident Account Holders and NR7-R Refund Applicants

- If you’re a NR7-R refund applicant, also complete and attach Form NR7-R, Application for Refund of Part XIII Tax Withheld

- Mail the completed form(s) to the address on the form(s)

It may take up to 21 days after receiving the form(s) to process this change.

- Get help:

-

Call for more information

- Telephone number

1-800-284-5946

Yukon, Northwest Territories and Nunavut:

1-866-426-1527Outside Canada and the U.S. (operates in Eastern Time):

613-940-8495- Hours

Hours in local time

Day Hours Mon to Fri 9 am to 6 pm (closed on public holidays) Sat and Sun Closed

Direct deposit for non-residents must be set up by mail. It cannot be done by phone. Call for information only.

If you need to change direct deposit or banking details for something other than personal taxes, benefits or refundsa businessa trustnon-residents:

Report a problem or mistake on this page

- Date modified: